“Be fearful when others are greedy, and greedy when others are fearful.” – Warren Buffett

Over the past month, UnitedHealth Group ($UNH) has faced the perfect storm: a sudden CEO resignation, missed earnings and suspension of guidance, a murky WSJ article about a DOJ investigation, and a last-minute selloff that raised eyebrows across the options floor. But while headlines scream panic, value investors should be paying attention—because what looks like fear might just be opportunity.

Value vs. Growth – What Warren Buffett Got Right

Much focus around investing and buying stocks goes towards a category called “growth.” Companies that fall into this category often have high upside, are popular on wall street and in the retail space. Tech companies like Nvidia ($NVDA) or Palantir ($PLTR)often have a significant innovation or hold on a piece of technology important to the market (like AI chips or AI-driven data analytics). Consumer stocks like Tesla ($TSLA) offer a unique product that changed or will change the market in a drastic way (like the first high-quality and affordable EV on the market). Big names like this generate catchy headlines and lots of attention and can provide tremendous value long-term. Growth stocks usually have extremely high valuations compared to their actual earnings.

But another type of investment can provide more stability in sure markets. Put simply, buy the value strategy says to buy proven businesses with existing customer bases and great operations when their value goes down, famously propagated by the most brilliant investor in history, Warren Buffett. The focus is on managing risk in the longer-term while generating returns and often large dividends.

Such is the case with DaVita ($DVA), a dialysis company. It offers structured and expected earnings in a non-discretionary industry that is also recession-proof. Similarly, UNH provides health insurance to millions of Americans, and despite recent downside and controversy, remains a relatively stable business whose economic prospects in the long term are solid.

Let’s look at why $UNH fits the value mold after recent chaos.

The Storm Around UNH

In February 2024, a UNH subsidiary called Change Healthcare suffered from a ransomware attack by a hacker group. The breach disrupted nationwide operations, affecting pharmacies, hospitals, medical providers, and halting claims processes. The cyberattack also compromised the personal data of almost 200 million people, making it one of the largest healthcare breaches in history.

UNH shares faced a small drop in price, but it quickly recovered in the following months and reach all-time highs of more than $600 per share in November.

In December 2024, UNH CEO Brian Thompson was murdered in New York while attending an investor conference. The incident took U.S. headlines by storm and shocked the business community. It also highlighted the tension between the U.S. for-profit healthcare system and its ability to actually treat the people it provides coverage for.

Last month, UNH reported Q1 earnings that fell short of expectations and guidance it had provided in the past. It missed revenue by about $2 billion and earnings per share by 1.2%. Shortly after, the CEO Andrew Witty resigned, supposedly for personal reasons.

That’s when the stock price really started to tank.

On May 14, 2025, the Wall Street Journal published a report claiming that the U.S. Department of Justice is conducting a criminal investigation into UNH Medicare Advantage billing practices. The report was published after trading hours, and UNH immediately denied the report, even saying that it was not being investigated by the DOJ. A trader bought a shady $3 million worth of puts one minute before the market closed.

Why UNH Stock May Be a Deep Value Opportunity in 2025

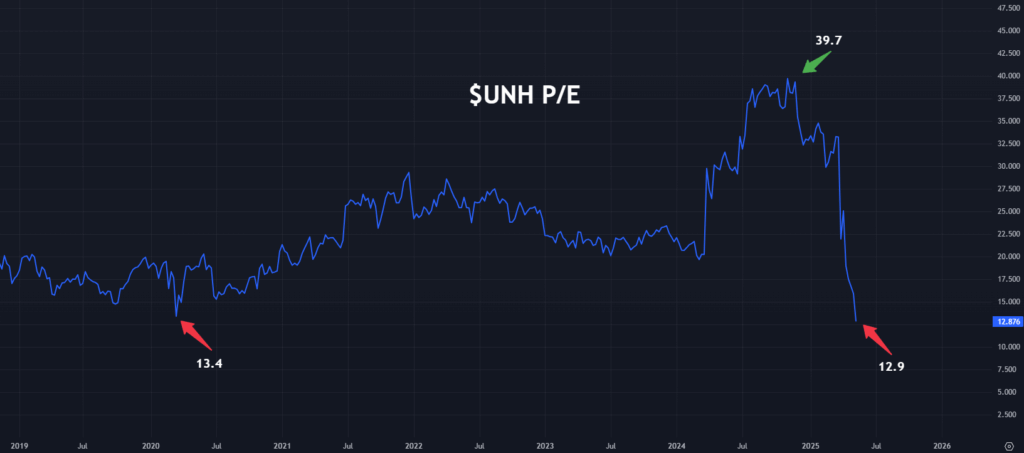

As of May 14, UNH has a 12.9 P/E ratio, which is historically low for its performance in the 2020s. It’s actually lower than its ratio the week that COVID hit the U.S. If the stock continues to fall lower over the coming weeks, a single-digit P/E is not out of the question.

For context, Cigna ($CI) and Humana ($HUM), two of UNH’s main competitors, both boast a p/e in the 16 range, and historically in the 20-30 range. This points to a serious undervaluation, even if UNH continues to go lower. This specific indicator has led to many great buying opportunities in the past. It’s almost unimaginable that a company as solid and large as UNH would go under, and it’s hard to imagine that it would stay at a P/E ratio like this in a few years’ time.

UnitedHealth Group’s stock has taken a beating in recent weeks—from CEO resignations and cyberattack fallout to a sensational WSJ article that the company flatly denies. Yet despite the noise, the fundamentals remain intact. With a fortress-like balance sheet, reliable cash flow, and dominant positioning in both insurance and health services through Optum, UNH is now trading at a P/E ratio near decade lows, far below its industry peers. History favors those who buy quality companies when the market overreacts. If you’re a value investor searching for an asymmetric setup in a blue-chip name, this might be the best entry point UNH has offered in years.

One response to “UnitedHealth Group ($UNH) – The Most Undervalued Blue Chip of 2025”

This article is a perfect blend of facts and practical advice.

Great site!